Best Prepaid Cards in The UK

Student Finance

7 mins read

Share

Updated at: 25 November, 2025

Published at: 19 January, 2023

By Hagar Samir

Best Prepaid Cards in The UK

Student Finance

7 mins read

Updated at: 25 November, 2025

Published at: 19 January, 2023

By Hagar Samir

Share

The concept of a prepaid card has been around for quite some time now, yet only some are fully familiar with what a prepaid card is! A prepaid card is a card you can use to pay for things. People buy a card with money loaded on it, and they can use the card to spend up to that amount. A prepaid card is also called a prepaid debit card or a stored-value card!

Any prepaid card is a payment card with a monetary value stored on the card itself, not in an external account maintained by a financial institution. So, there is no network access required by the payment collection terminals! Funds are both withdrawn and deposited straight from the card.

There are several benefits to a prepaid card. Of course, they are very easy to use and reload. They also lessen the risk of overspending and are safer than cash! You can also use them pretty much anywhere, as everyone nowadays provides services that can be paid for by a prepaid card! Also, you put a specific amount of money on it, so you can also try and save up!

Differences Between a Prepaid Card, a Debit Card, and a Credit Card

Before we tell you what the best-prepaid cards are, we are sure you’re wondering what the differences between a prepaid card, a credit card, and a debit card are; everyone has asked that question at least once in their life!

As we already mentioned, a prepaid card is not linked to a bank account. When someone uses a prepaid card, they are spending money that they have already loaded onto the card without having to go to the bank!

Prepaid Cards and Debit Cards

When you open a checking account at a bank or credit union, you usually get a debit card. A debit card lets you spend money from your checking account without writing a check! Unlike prepaid cards, you’re directly linked to the bank. When someone pays with a debit card, the money comes out of their checking account immediately.

With prepaid cards, you can only spend the amount of money you added in your card, overspending can occur with a bank account debit card. Also, your bank may charge you a fee for covering the cost of a purchase or ATM withdrawal when it exceeds what you have in your account! You can choose which is more convenient for you, some people prefer prepaid cards and others use debit cards more!

Prepaid Cards and Credit Cards

Credit cards are a different case than both prepaid cards and debit cards. Both prepaid cards and credit cards have card network logo such as Visa, MasterCard, American Express, or Discover on them, which can be very confusing to some people!

Using a credit card means you’re borrowing money from the bank that you have to return within a pre-approved credit limit. The difference between a prepaid card and a credit card is that when you are using a prepaid card, you are spending money you have already put in your card, while with credit cards you are using money that needs to be returned to the bank!

Of course, you are always free to choose anything from a prepaid card, a debit card, or a credit card! But you have to understand what each card means and what you’re going to do when you choose one to avoid problems with the bank!

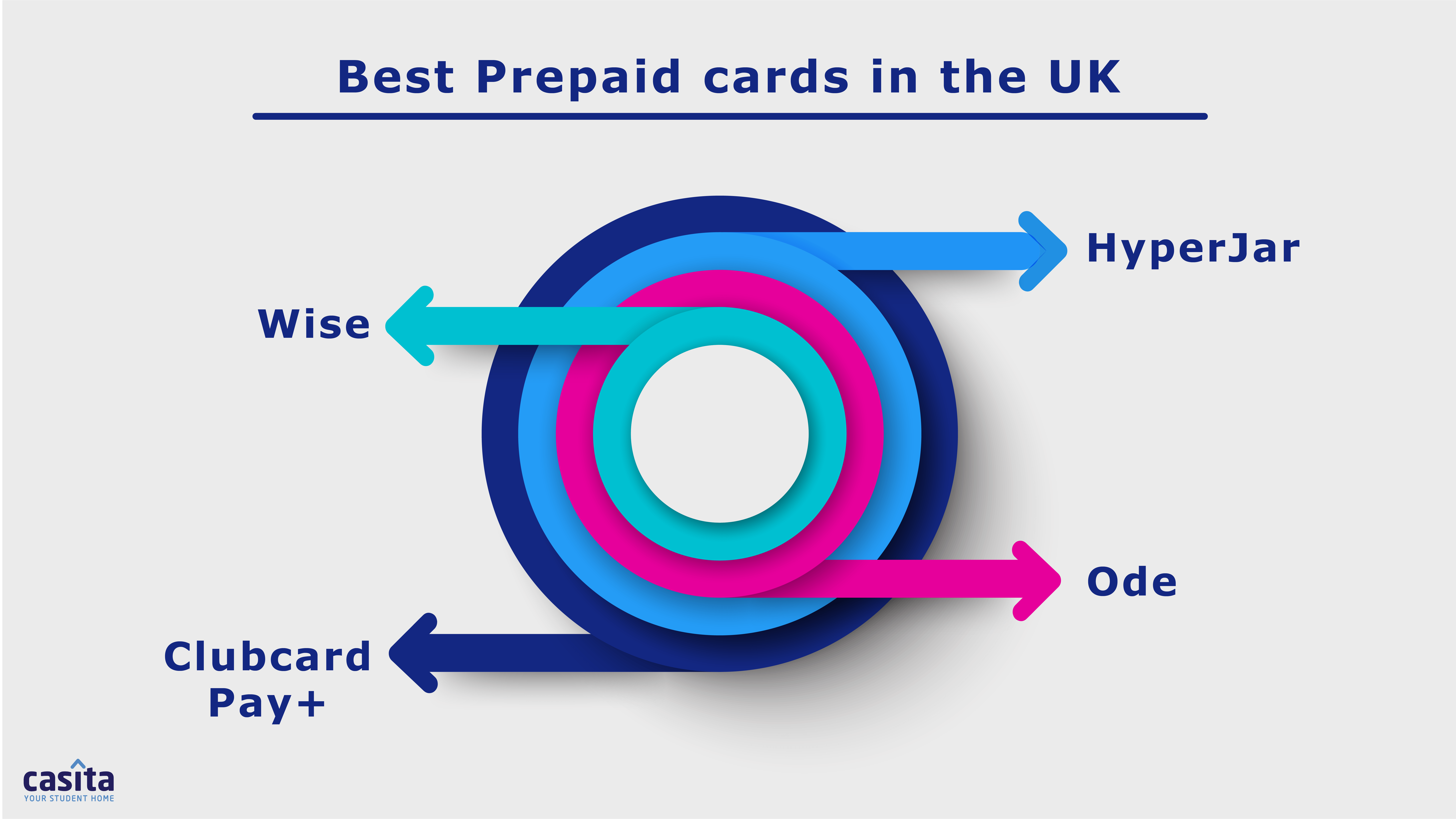

Best Prepaid Cards in the UK

So, you understand what prepaid cards are, and you know how to differentiate between them and the other card types, and you choose to proceed with a prepaid card; it is now time to choose a good prepaid card to start your journey!

There are several good prepaid cards in the market, and they all offer various benefits for you to choose from! In the United Kingdom, prepaid cards are popular and used very often, especially by students, everyday! Let’s take a look at the best prepaid cards in the UK!

Wise

Wise is a prepaid card that's suitable for UK and international spending! This card allows you to send money to 80 countries and hold over 50 different currencies! Nowadays, this flexibility is needed because people can work for companies in the UK from almost anywhere, so sending and receiving money is crucial! Having a card that can help with that made a lot of people invest in it!

If you travel often or you do any freelance work for which you receive payment in a different currency, Wise is the perfect option for you! It is a free card, so you won’t have to worry about any fees for you to open an account with them, nor do they have any monthly charges!

Clubcard Pay+

Tesco Bank provides Clubcard Pay+ where you get a digital prepaid card which you can use via their app! It has no charges and has greater protection than other cards in the United Kingdom, the money gets the usual Financial Services Compensation Scheme (FSCS) protection most bank and savings accounts offer, which can go up to £85,000 per person!

In addition to that, you'll earn Clubcard points for using the card, even if you don't spend it at Tesco! You get the regular one point per £1 when shopping at Tesco, but you can also get one point per £8 when using the card elsewhere! Another plus is the Round Up savings account that can help make it so much easier to save money without trying!

HyperJar

A very efficient budgeting tool paired with a prepaid card is HyperJar! What is really interesting about this card is the money jars, where you can divide your spending on anything, including coffee, gifts, and groceries! This makes it so much easier to actually have a budget plan and put money aside for bigger purchases!

There is also the option to create a shared jar that you can use, for example, for splitting the cost of bills with your housemates! By doing that, you are aware of everything you spend, making it easier for you to track your money and where it goes!

Ode

Working in education, healthcare gives you access to the Ode prepaid card! Also, if you’re a carer or a charity worker, you can also get this card. This card gives you cashback that can go up to 16% at over 80 retailers, including Asda, Argos, Boots, Pizza Hut, Sainsbury’s, and so much more!

After the first year, a £2.99 annual fee kicks in, so don’t hesitate to cancel if you find you're not earning much cashback from it, or if you realise you’re losing more money than you’re making! There is also an inactivity fee of £5 per month, but that only applies to accounts over two years old that haven't been active for 12 months!

Pros and Cons of a Prepaid Card

Of course, everything has its advantages and disadvantages, prepaid cards are just the same! Aside from the fact that it depends on someone’s preferences, they can also view something as a good thing and other might not! Below is a breakdown of the “pros” and “cons” of a prepaid card!

Pros of a Prepaid Card

There are many advantages of prepaid cards! For starters, you will have your money loaded into a card instead of carrying it around in cash, which is a lot safer! Also, everyone nowadays accepts card payments, including vending machines, so they have huge widespread functionality, and you won’t have to worry about not carrying cash!

In addition to that, several prepaid cards can be used abroad, which facilitates the transfer of the money if you’re not working for a local company! They will also be much more convenient if you’re travelling abroad and you want to spend money!

The process of getting a prepaid card is really easy, you just need a proof of your identity and to be over 18 years old! It is also easy for people who don’t have much money or with little to no credit history to access this card! They are also very easy to load, you can put money onto them using cash, through online banking, or even over the phone!

Cons of a Prepaid Card

Of course, if there are pros to something, there will also be cons! The fact that prepaid cards do not work like credit cards does not sit right with some people. You do not have the option of buying something and then paying later, and despite that this may seem like an advantage to some people, others prefer having the option.

Also, one of the main disadvantages of having a prepaid debit card is the fact that since the money is not linked to a savings or checking account or a bank in general, you will not be gaining any interests. Again, this is really subjective, as some people use this card for specific reasons and have a bank account that gives them interests on their money!

If by any chance your prepaid card get stolen or is lost, many issuers may have a stricter time-frame for when you have to cancel it as compared to a credit card. There is also no guarantee that you will get your money back if someone has used it when it’s not with you.

Now that you know what a prepaid card is, how different it is from a debit or a credit card, its pros and cons, and the best prepaid cards in the UK, you can easily decide whether you want one or not! It is also wise to see how and why you want a card in general in order to help you decide.

Frequently Asked Questions

1. What is the best prepaid card to use in the UK?

The best prepaid card in general might differ from one person to the other. People use prepaid cards for different reasons, however, if your goal is to just spend money using it, Wise will be a good choice for you!

2. Is there a difference between a prepaid card and a credit card?

There is a huge difference between them. Both cards are valuable and beneficial, but each card is for a specific use!

Student Finance

By Hagar Samir

Share

Student Finance

Updated at:

Published at:

By Hagar Samir

Share